Edinburgh ranks among top 5 UK universities for producing most spinouts

A new report has named the University of Edinburgh* in the UK’s top 5 most prolific universities at commercialising innovation, according to research into university spinout companies.

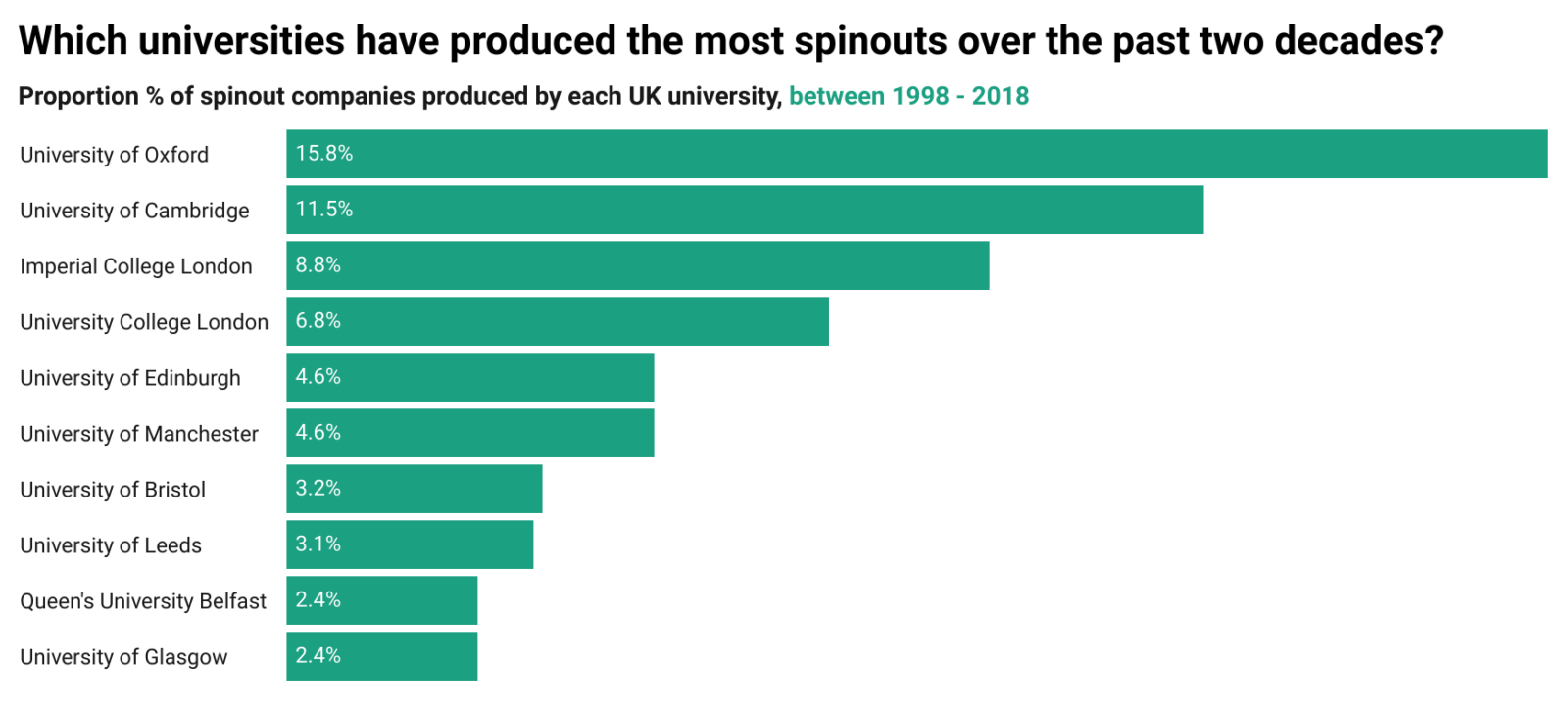

* 4.6% of the UK’s spinouts were started at the University of Edinburgh

The university is commended for generating some of the highest value spinout companies in the UK, with the most successful from the last 20 years being MTEM, currently valued at £140 million.

The University Spinout Report 2021 celebrates the UK’s position as a global leader in innovation and is based on analysis of just under 1,000 UK spinout companies, a sample that comprises £19.28 billion of capital invested, 4,489 deals and 1,907 investors.

The report is provided by Source Advisors, the UK R&D tax credits and innovation specialists (rebranded from GovGrant as of 1st February 2024).

One sixth of spinout companies in the UK (16%) originated from Oxford University. This is followed by the University of Cambridge with more than 11% of UK spinout companies and Imperial College London, which has contributed to 9% of the UK total.

The report also provides notable mentions for the universities seeing recent growth in their commercialisation of innovation. When analysing growth data from the last decade, the University of Strathclyde has made strides into the top 10, having come just outside of it prior to 2008. The Royal College of Art also comes in at number eight on the list of the most prolific institutions for commercialising innovation in the UK over the last decade.

Analysing company data, the University of Oxford has six spinouts in the top 10 by value. Spinouts from the university have a total value of £8.1 billion. Imperial College London’s leading spinout is Ceres Power, which comes second in the top 10 and is valued at £1.98 billion. The University of Dundee features fourth on the list with Exscientia, a company valued at £784 million.

In total, the top 10 UK spinout companies by valuation are worth approximately £9.8 billion. Of these 10, eight are in the healthcare industry. Healthcare is the dominant sector for successful UK spinouts, accounting for 45%. IT is the next most successful with 24%, almost half as many as healthcare.

Adam Simmonds, Investment Research Analyst, says: “ This report highlights the huge value to the economy of UK universities, as well as the incredible depth of creativity and talent at our universities.”

“ It’s no surprise to see pharmaceutical and biotech spinouts feature prominently: the UK is particularly renowned for innovation in these areas. You only need to look at the recent development of Covid-19 vaccines in the UK to see how accomplished we are in pharmaceutical innovation.”

David Richardson, Chief Entrepreneurial Executive at Heriot-Watt University, says: “ Universities are a rich source of cutting-edge research which enables new learning, discovery, and innovation. Cutting edge research and the ability to develop and understand how new technologies advance industry and society are critical factors for ensuring future prosperity.”

“ Success comes from building on research specialisms, and using these to catalyse new collaborations, investment, and jobs through the development of dynamic ecosystems focused on advanced R&D, talent development and commercialisation.”

“ In addition to investment, spin-outs attract skilled graduates and high-performing academic researchers from across the globe to the UK. On average, they recruit around 12 employees per company. Between 2016 and 2018 alone , UK university spin-outs employed over 23,000 people.”

Edinburgh Innovations, the University of Edinburgh’s commercialisation service:

“ Our startups and spinouts regularly attract investment from leading venture funds. This includes investment from Old College Capital, the University’s in house venture capital fund. In the current financial year, our client companies have attracted a record £35 million to date.

“ Our entrepreneurs have an enviable record of success and company longevity. ”

Data applies to period from 1998 to 2021 and was analysed with company value attained July 2021.